If you’ve decided to pursue the CFA (Chartered Financial Analyst) designation, congratulations — you’re on a rigorous, prestigious journey that demands dedication, discipline, and time. While the Level 1 exam lays the foundation of financial knowledge, Level 2 takes that understanding and pushes it much further into application and depth. As many CFA candidates discover, the jump from Level 1 to Level 2 is not just a step — it’s more like a leap.

TLDR;

The transition from CFA Level 1 to Level 2 is significant and often underestimated. While Level 1 focuses on basic financial concepts and definitions, Level 2 dives deep into complex valuation techniques, analytics, and real-world scenarios. The format changes too, with Level 2 introducing item sets (mini case studies) that test critical thinking and integration of concepts. Be prepared for a major increase in difficulty and required study time.

Understanding the Core Differences

At a glance, both CFA Level 1 and Level 2 cover ten core topics. However, the depth and weightings of each subject change dramatically as students progress. Here’s a brief comparison of the two:

- Level 1: Emphasizes foundational knowledge — definitions, formulas, and basic applications.

- Level 2: Demands analytical skills — interpreting financial statements, valuation intricacies, and contextual problem-solving.

This shift in focus means that the learning style and strategies that may have worked for Level 1 won’t necessarily guarantee success in Level 2.

Syllabus Comparison

Let’s dive into the subject areas and how they evolve from Level 1 to Level 2.

1. Financial Reporting and Analysis (FRA)

In Level 1, FRA covers basic concepts like the three financial statements and standard accounting principles. You’ll learn terms, complete simple ratio analyses, and understand revenue recognition rules. In Level 2, however, this subject transforms into something much more technical.

- Level 1: What is goodwill? What is FIFO? How do ratios work?

- Level 2: Analyze complex intercompany investments, pension accounting, currency translation effects, and fair value hierarchies.

Mastery of Level 2 FRA not only requires memorization, but also critical interpretation of accounting data in different regional contexts.

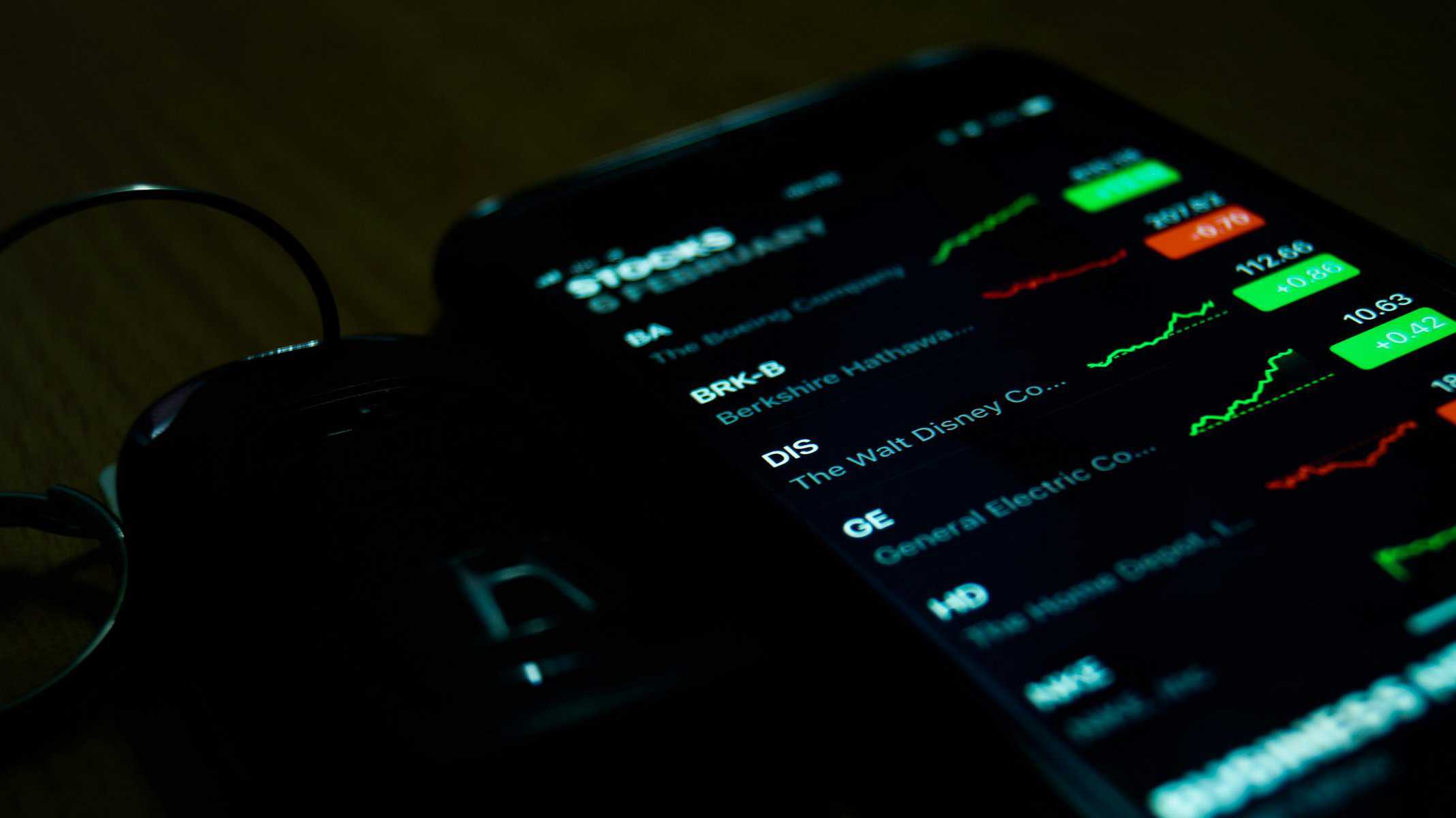

2. Equity Valuation

Equity concepts in Level 1 focus on understanding markets and basic valuation models (e.g., DDM, P/E ratios). In Level 2, you need to calculate multi-stage DCF valuations, residual income models, and back out assumptions from complex problem sets.

This is where many students feel the heat — the calculations are longer, the margin for error smaller, and the reading volume denser.

3. Quantitative Methods

Level 1 Quants introduces time value of money, basic statistics, and probability theory. By Level 2, you’re knee-deep into regression models, multicollinearity, heteroskedasticity, and autocorrelation — all terms you may not even recall from Level 1.

- Level 1: What’s standard deviation? How do you discount cash flows?

- Level 2: Identify types of errors in multiple regression outputs and correct biases statistically.

In short, Quantitative Methods in Level 2 is far more analytical and numerical in nature, demanding conceptual understanding and formulaic rigor.

Format and Question Type: The Item Sets

Arguably the most jarring change from Level 1 to Level 2 is the exam format. Level 1 consists of multiple-choice questions (PM-style) — three choices per question, testing isolated facts or simple concepts. Level 2, however, introduces the dreaded Item Set format.

An Item Set includes a case study (called a vignette) followed by six questions that pertain to that vignette. These aren’t short and sweet — each vignette spans around 1 to 2 pages and tests integration across multiple curriculum areas.

- No more quick wins: You can’t skim and guess a single factoid. Every question is tied to a story or case study requiring comprehension and context.

- High stakes: If you misinterpret the vignette or miss key assumptions, you could easily get all six linked questions wrong.

This increases the cognitive load per question and raises the bar for exam pacing and endurance. Many students find themselves running short on time during practice exams — a problem they rarely experienced in Level 1.

Time Commitment and Study Strategies

CFA Institute recommends about 300 hours of study per level, but anecdotal evidence suggests that:

- Level 1: Most candidates manage with 250–300 hours.

- Level 2: Students often report needing 350–450+ hours, reflecting the increased complexity and volume.

Here are some strategy shifts needed to survive the Level 2 syllabus:

1. Context over Memorization

Memorizing formulas alone doesn’t suffice in Level 2. You need to know when and how to use them and understand implications in practical scenarios.

2. Practice More Vignette-Based Questions

Transition your study approach from flashcards and bullet-point summaries (Level 1 style) to in-depth readings and full item set practice. Study sessions should mimic the exam environment to build stamina and comprehension.

3. Time Management Becomes Key

Level 2’s item sets are time-consuming. Allocate your minutes wisely: approximately 3 minutes per question, including time to read the vignette thoroughly. That’s just 18 minutes per item set.

Emotional and Mental Difficulty

It’s not just the content that’s harder — the psychological strain also jumps. Many candidates report that:

- They feel less confident going into Level 2 exams.

- Practice scores stay lower for longer compared to Level 1 prep.

- The burnout risk is higher due to sheer volume and advanced difficulty.

This makes emotional endurance a crucial part of success at Level 2. Study consistency and resilience are often more important than brilliance.

Pass Rates Paint a Clear Picture

The historical pass rates for Level 1 and Level 2 show the real leap in difficulty:

- Level 1: ~41% (historically higher in pre-pandemic years)

- Level 2: ~44%, but it’s earned only by the most dedicated and prepared

Many fail Level 2 after barely clearing Level 1, thinking similar effort will suffice. Underestimating how much tougher it gets can be costly.

Final Thoughts: What It All Means

The shift from CFA Level 1 to Level 2 mirrors the evolution from college-level theory to real-world financial analysis. The curriculum jumps from definitions to deep dives, from isolated questions to synthesized application. It’s an intimidating step — but not an impossible one.

Those who succeed tend to:

- Respect the exam’s difficulty early on

- Plan study schedules carefully

- Practice extensively with quality item set questions

- Seek to understand, not just memorize

In conclusion, Level 2 is not just the next level — it’s a whole new game.