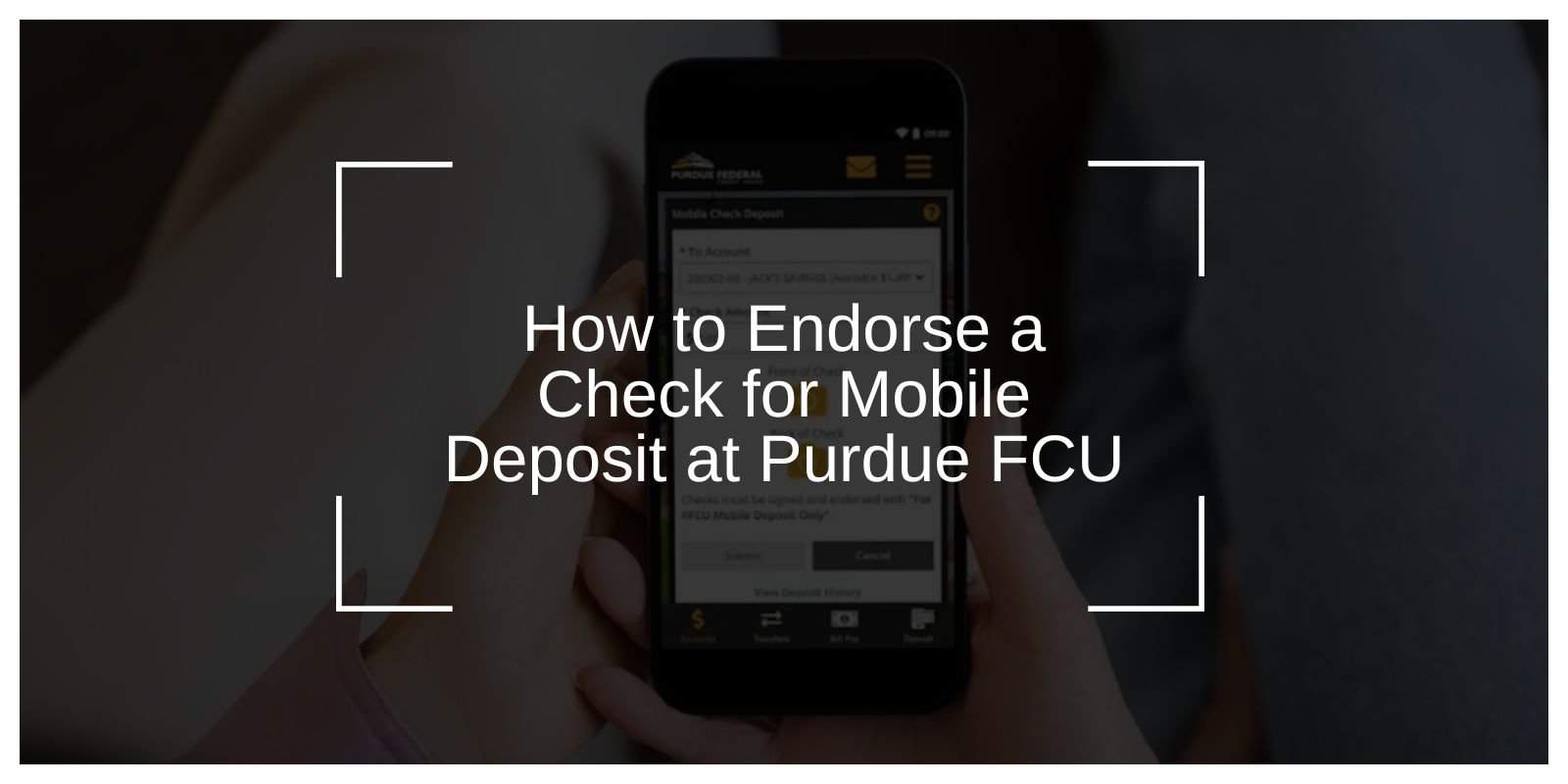

Mobile check deposit is a convenient feature offered by Purdue Federal Credit Union (Purdue FCU), allowing you to deposit checks through their mobile banking app without visiting a branch. However, properly endorsing the check is essential to ensure your deposit is processed without delays. This guide explains how to endorse a check for mobile deposit at Purdue FCU and provides step-by-step instructions to complete the process.

What Does It Mean to Endorse a Check?

Endorsing a check involves signing the back of the check to authorize its deposit or cashing. For mobile deposits, endorsements usually include specific instructions or markings to indicate that the check is being deposited via a mobile banking app.

Why Proper Endorsement Matters:

- Prevents Fraud: Ensures that only authorized persons can deposit the check.

- Avoids Delays: Incomplete or incorrect endorsements can lead to rejected deposits.

- Meets Banking Policies: Financial institutions like Purdue FCU have specific endorsement requirements for mobile deposits.

Steps to Endorse a Check for Mobile Deposit at Purdue FCU

Follow these steps to properly endorse a check for mobile deposit:

1. Verify the Check Details

- Ensure the check is written out to you or an account holder at Purdue FCU.

- Confirm the amount and date are correctly filled in.

2. Sign the Back of the Check

- Flip the check to the back, where it says “Endorse Here” or provides a similar endorsement area.

- Sign your name exactly as it appears on the front of the check.

3. Add “For Mobile Deposit Only at Purdue FCU”

- Write “For Mobile Deposit Only at Purdue FCU” directly under your signature.

- This is a key step to indicate that the check is being deposited electronically and cannot be cashed elsewhere.

4. Double-Check the Endorsement

- Make sure the signature and instructions are clear and legible.

- Check for any smudges or errors that could lead to processing issues.

5. Deposit the Check Using the Purdue FCU Mobile App

- Open the Purdue FCU Mobile App on your smartphone.

- Log in with your credentials.

- Navigate to the Deposit Checks section.

- Take a photo of the front and back of the endorsed check as prompted.

- Confirm the deposit details and submit.

Tips for a Successful Mobile Deposit

Here are some practical tips to ensure your mobile deposit at Purdue FCU is successful and hassle-free.

- Use Clear Lighting: Ensure the check is photographed in a well-lit area to avoid shadows.

- Keep the Check Flat: Place the check on a flat, dark surface to improve image quality.

- Retain the Check Temporarily: Keep the physical check for at least 14 days after deposit to ensure the funds are cleared.

- Follow Deposit Limits: Check Purdue FCU’s mobile deposit limits and ensure your check amount falls within the allowable range.

FAQs About Mobile Check Deposits at Purdue FCU

1. Do I Need to Write Anything Else on the Check?

No, the endorsement requires your signature and the phrase “For Mobile Deposit Only at Purdue FCU.”

2. What If I Forget to Endorse the Check?

Your deposit may be rejected, and you’ll need to resubmit it with the proper endorsement.

3. How Long Does It Take for Funds to Be Available?

Funds are typically available within 1–2 business days, but this may vary based on Purdue FCU’s policies.

4. Can I Deposit a Check Made Out to Someone Else?

No, the check must be made out to the account holder or properly endorsed to you.

Conclusion

Endorsing a check correctly is a crucial step for successful mobile deposits at Purdue FCU. By following the steps outlined above, you can avoid delays and ensure your funds are deposited smoothly. Always double-check your endorsement and use the Purdue FCU mobile app for a seamless banking experience.

Have questions about mobile deposits? Share your thoughts in the comments below, and don’t forget to share this guide with others who bank with Purdue FCU!